DON'T SHORT THE USA

Sovereign Nation States Emerge From The Shadows

Financial crash? “Uncertainty”? Woe betide those who ‘short’ this American President and his principals, some 24 cabinet-level officials! They are betting on a system that is dying and being replaced.

Revolutionary changes in American domestic and international relations are underway. America’s President and his administration are, with enthusiasm, overturning the globalists’ former “rules-based order.”

Here it is the industrial expansion of the US economy, the rebuilding of the US industrial base and its productive workforce, which is of primary concern. That rebuilding process must increasingly rely on domestically produced, advanced machine tools, industrial machinery, and robotics.

On September 24, 2025, the US Department of Commerce Bureau of Industry and Security (BIS) announced the initiation of an investigation into the effects on US national security of imports of robotics and industrial machinery.1

Tariffs

This is also the substance of President Trump’s tariff actions2. [LINK] For it is the “competitive edge” of tomorrow’s real economy which is actually front and center.

The President’s dramatic April 2nd “Liberation Day” and August 1st tariffs put in place “a wall” against transhipments as well as dumping. The domestic costs of tariffs are a one-off; there is no inflation as there is no increase in the money supply. Instead, there is the beginning of a necessary transformation of the political economy of the United States itself. A new, robust “American System” of producers is already emerging.

The abrupt and flanking return to American System tariff policies sent shock waves through global banks, international corporations, and the Davos crowd of lemmings.

Nation States Emerge From the Empire’s Shadows

In short, Trump’s Asia tour was a resounding success for all. Trump is not merely ‘leveling the playing field’ of commercial trade. The changes wrought by President Trump and the new combinations and alliances that he and his administration are creating are altogether supplanting the dying empire of parasitical, globalized, central bank-orchestrated, ‘high’ finance.

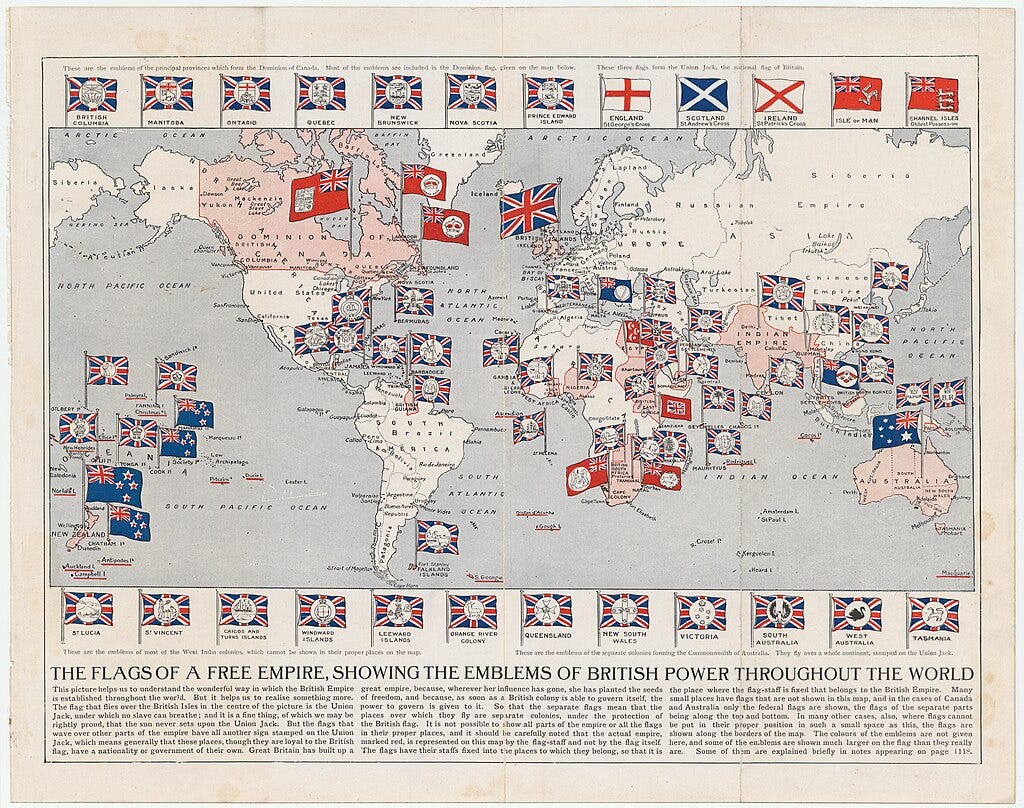

Dramatically, principled nation-to-nation relations are replacing the global “free market.” What has been, in truth, a flea market ruled from above by the globalist institutions of an Anglo-Dutch financial oligarchy.

Now trillions of dollars in new heavy industrial and energy investments into the USA have been organized by President Trump and his talented team of trade negotiators.

This is not simply a boon to the USA and its working families. In ALL of the real economies of the participating nation states, these hard capital investments into the USA will, in turn, drive a resurgence of their own physical economic growth! This must not be missed, in understanding what is now underway.

Altogether, tens of trillions of dollars of investments have been committed and already begun flowing into nuclear energy, ship building, steel production, gas & steam turbines, transformers, and semiconductor chips. This is real, profitable demand for new physical output from the economies of our trading partners. Japan, long mired in “lost decades” and green polices; South Korea, facing a shrinking of its heavy industrial base, are now to be unleashed. These are but two, very clear examples.

On the home front, major new advanced energy, industrial and infrastructure projects are being propelled forward by the Trump administration. This while the financial oligarchy, its bought-and-paid-for politicians, and it’s mass media outlets (both lame-stream and complicit ‘new’ social media) still try to spread their hand-wringing pessimism and fear.

It should really not be that mysterious, and Americans now catch on fast.

The Import of President Trump’s Negotiations

To make the point clearer, quickly review the negotiations that have occurred “in but a twinkling of an eye.”

The negotiations with South Korea were with the government of South Korea; negotiations with Japan were with that nation’s sovereign government. South Korea’s and Japan’s commitment to invest $900 billion into the US physical economy (”strategic investments”) are new investment opportunities and capital goods exports markets for the corporations of these respective allied nations. Not consumer electronics and t-shirts! An overlapping process has involved securing rare-earth metals and their processing. Of course nations are bringing their respective business & societal leaders into the outcomes.

Combine this with:

Negotiations in the Middle East (West Asia), and Southeast Asia have been with the government leaders of the respective nations and included the majority Muslim nations of Indonesia and Pakistan. The Abraham Accords have been the overarching conceptual approach.

The on-going negotiations are intended to incorporate all majority-Muslim nations into the Abraham Accords -- in efforts to secure lasting peace through shared economic prosperity.

In Ibero-America, Trump’s interventions are unseating the narco-state apparatus through which ‘The City’ of London and Wall Street had imposed that money-laundering “spider web” that has been central to a modern-day British East India Company empire. Sovereign nations are emerging there again.

Strategically, the deep, multifaceted US negotiations with both Russia and China are continuing as well.

This is what has the The Economist of London and Wall Street Journal gnashing teeth and spewing bile. Why? Think about it: global financial institutions including central banks and the international private banks -- as well as BIS, IMF and World Bank -- have little or no say! Nor the equity “market,” global commodity “markets” or global “currency markets.” They are left to abreact to:

.... “Green,” rigged markets are now left behind, stranding predatory ‘investments.’ Those imposed “Green New Steal” policies never represented national interests, but rather globalist corporativist policies directed down from London and Davos into and through government shells (’Obama,’ ‘Biden,’ ‘Chancellor Merkel’ or ‘Merz,’ a ‘Macron’ -- or pliable global south ‘leaders’).

.... The disruption of financial capital flows Financial flows from Asia, the Arab world and even Europe are being diverted into real industrial and manufacturing investments in the USA. These are flows that are draining the lifeblood out of the casino mondial. Major economic institutions, including the International Monetary Fund (IMF) and J.P. Morgan, cry out that the “tariff shock” is having a negative impact on “global economic growth” and creating an overall “negative supply shock.” 3 NOTE

.... Likewise a disruption of the global commodity markets. As President Trump and his principals overturn EPA and other legislation that stood in the way of copper, oil and other US mining projects; as mining investments in the USA are negotiated with countries such as Japan; as federal equity positions aid the development of US rare earth processing; and as rare earth sources and production capacity are tapped in Asia and Australia, there is the rapid “de-leveraging” of positions held by former commodity market “insiders” in Switzerland, London and Hong Kong.

... The “pressure on central banks”4 The pressure on central banks is not coming from President Trump, Treasury Secretary Bessent and director of the Federal Housing Finance Agency, Bill Pulte pounding on Jerome “Too-Late” Powell and the Fed.

In reality the pressure, throughout these decades, as witness the financial panic of 2007-2009 and ensuing bank bailout under Bush & Obama, has been to insure that all liquidity is directed to sustain “market” valuations of the Anglo-Dutch Empire of financialized, highly leveraged debt, facilitated by a transnational system of central banks, off-shore banking, and trading platforms. This is the predatory bubble which is threatened.

This is why the Bank of England, Goldman Sachs, and Morgan Stanley are suddenly ‘predicting’ a financial crash triggered by a meltdown of the AI market bubble!

The Bank of England itself5, the IMF, Morgan-Stanley and Goldman Sachs6, weigh in. They and the mass media all noisily assess that a “correction or a crash” is about to occur in the stock exchanges, warning solemnly that the AI mania is likely a new Tulip Bubble.

Of course this has been their stock market run-up, pumped up by the bank- bailouts triggered in the financial panic of 2007-2009, and then the 2020-23 Covid bailouts. They were the promoters of the run-up of the “Magnificent Seven” of Big Tech, along with the Federal Reserve and the BlackRock, State Street, and Vanguard ETFs.

The Council on Foreign Affairs (CFR) even musters the hubris to promote a piece in Foreign Affairs, asserting that President Trump’s US energy sales to the world will soon backfire. That it will result in growing global support for reduced energy consumption and a return to insane wind and solar ‘un-reliables,’ impoverishment & entropy. Is anyone listening?

This writer suggests that, now, it is unwise to short the United States and its nation state allies. It is unwise, under the current realignment of nation states and their sovereign powers and citizens, to ‘bet against’ the President of the United States.

https://www.federalregister.gov/documents/2025/09/26/2025-18749/notice-of-request-for-public-comments-on-section-232-national-security-investigation-of-imports-of

The investigation could result in the imposition of tariffs or other import restrictions by Spring 2026.

https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-declares-national-emergency-to-increase-our-competitive-edge-protect-our-sovereignty-and-strengthen-our-national-and-economic-security/

The reader should bear in mind that the tech boom into AI is one set of investments that is said to be offsetting (bailing out) troubled financial markets in the recent months.

https://www.bankofengland.co.uk/bank-overground/2025/all-chips-in-ai-related-asset-valuations-financial-stability-consequences

https://www.cnbc.com/2025/11/04/goldman-sachs-morgan-stanley-warn-of-a-market-correction.html#:~:text=Goldman%20Sachs%20and%20Morgan%20Stanley,have%20warned%20of%20overvalued%20equities.

Interesting perspective on the US economy. I found the shift from the "rules-based order" particularly thought provoking. How do you envision this impacting broader international cooperation and stability?